Capital Framework & Management

Overview

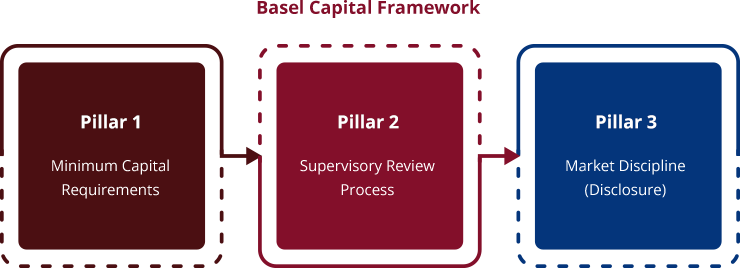

The Basel capital framework details the set of policies, processes, models and tools that banks should develop and implement to secure regulatory approvals for adoption of risk-based capital requirements under the framework. The capital framework should be seen as an opportunity for banks to embrace the risk-sensitive business practices and risk management processes to improve their competitive edge. The chart below provides an illustration of the three key pillars of Basel Capital Framework:  Adoption of the Basel Capital Framework will result in:

Adoption of the Basel Capital Framework will result in:

- Risk-sensitive information that banks can use for credit approval, limit setting, pricing and portfolio optimisation and capital allocation

- More efficient allocation of capital based on levels of risk of various lines of business and portfolios

- Ability to offer competitive loan pricing vis-à-vis banks that are not Basel ready (particularly for borrowers with good credit)

- Potential for more favourable credit ratings and hence lower cost of funding for banks that are known to have adopted risk-based practices under Basel capital framwork

Our Services

Our consulting services for Basel Capital Framework include the following:

- Provide advice on Basel capital framework requirements and implementation approaches, including references on industry practices adopted by regulators and banks in other jurisdictions.

- Assist banks in Basel capital framework compliance assessment through the conduct of detailed gap analysis, and provide recommendations on the closure of identified gaps, which may cover policies, processes, data, computation methodologies and technology/system platform changes.

- Advise banks on implementation of Basel capital framework approaches, including:

- Definition of policies and processes on asset classification, external ratings, use of internal ratings, credit risk mitigation, etc, in line with the deployment of relevant Basel -related systems

- User requirements for system enhancements in line with SA and IRB requirements

- Evaluation and selection of RWA computation engine

- Calibration of model outputs

- Preparation for certification by national supervisor

- Credit Rating Model Development and Validation (please refer to section on Credit Risk Management)

- Use Test Implementation: In line with Basel capital framework, banks must have a credible track record in the use of internal ratings information in its business and support operations. We provide advice to assist banks in the development of Use Test Framework, including policies and processes for areas such as:

- Credit Approval

- Limit Management

- Reporting of Credit Risk Information

- Pricing

- Other broader risk management activities, such as provisioning, credit risk appetite, regulatory capital calculation, profitability and performance measurement, etc.

- Measurement and management of Pillar 2 risk-types including Liquidity Risk, Interest Rate Risk in the Banking Book, Credit Concentration Risk, Climate Risk, Reputational Risk and Strategic Risk etc (refer to our services under Strategic Management Consulting).

Overview

Banks are required to meet minimum regulatory capital requirements, which are calibrated to protect depositors and may not ensure survival of the bank in a crisis. Over and above regulatory capital, financial institutions also maintain capital to ensure the ability to survive as a going concern in the event of significant unexpected losses.

To do so effectively, financial institutions need to:

- Articulate the level of risk that it is prepared to take

- Take stock of its financial resources that will be available to meet unexpected events

- Closely monitor its capital adequacy on an on-going basis

- Put in place capital contingency plans

In addition, one of the key requirements of Pillar 2 under Basel capital framework is for banks to have an internal process for assessing their overall capital adequacy in relation to their risk profile and a strategy for maintaining the required level of capital. This process is known as Internal Capital Adequacy Assessment Process (ICAAP) and constitutes the core process in the management of the bank’s capital.

Our Services

To assist banks in capital management as well as meeting Pillar 2/ICAAP requirements, we provide consulting services in the following areas:

- ICAAP policy and processes: Provide a set of recommendations covering the governance structure and processes that the bank should put in place for the monitoring of capital adequacy, capital planning and capital management.

- Risk Appetite Setting (RAS): Design and develop the bank’s RAS that articulates the nature and level of risk that the bank is willing to take in the pursuit of its strategic objectives. This will include the RAS framework, roles and responsibilities, identification and calibration of RAS indicators and relevant processes.

- Capital Adequacy Assessment: Develop the necessary framework, approaches and processes to identify, measure and monitor the types of risks that are not specifically covered under Pillar 1, and estimate the amount of additional capital required.

- Capital Planning and Management: Develop an overall plan for meeting the bank’s total capital requirements, and adopting measures to address any expected capital shortfall and ensuring optimal use of any expected capital excess.

- Economic Capital (EC) Computation: Review and enhance/develop EC models and the computation methodology adopted. This will take into consideration the robustness, granularity and correlation structure of such EC models.

- Capital Allocation: Provide advice on how capital can be most appropriately allocated to the business units based on the expected returns and in accordance with their credit, market, operational and other risk exposures.

- Recovery Plan: Develop a recovery plan that specifies the range of feasible and effective recovery options that a bank will execute under various recovery scenarios, detailing the impact, execution time, dependencies, constraints, long-term consequences and responsible unit for execution for each recovery option.