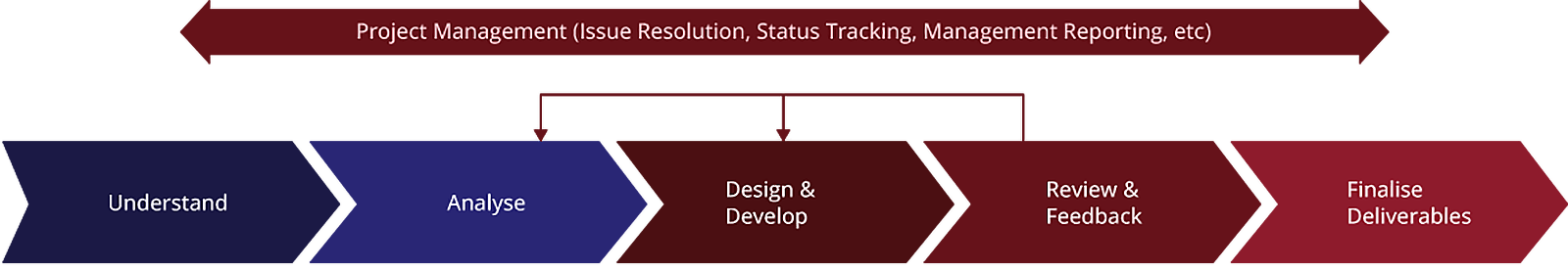

Our Consulting Methodology

We adopt a structured, systematic and pragmatic approach in all our consulting engagements:

Understand

- In depth fact-finding with the client to understand existing conditions, issues and constraints.

Analyse

- Analysis of As-Is conditions, issues and constraints.

- Study of possible solutions to the issues and constraints identified.

- Design of guiding principles for Target Operating Models and solution development.

- Seek consensus with the client on outcome of analysis and proposed approaches.

Design & Develop

- Design and development of proposed solutions and deliverables.

- Reiteration of the process till optimal solutions are developed.

Review & Feedback

- Review of deliverables by the client’s Project Sponsors.

- Discussion on feedback and amendments, if required.

Finalise Deliverables

- Finalisation of proposed solutions and deliverables.

- Presentation to the client’s management.

On-going Quality Assurance (SME)

We work closely with the client project team to proactively manage project issues and track progress, to ensure that the:

- Recommendations are benchmarked to best industry practices;

- Solutions are customised to the client’s needs and implementable; and

- Project is completed within schedule.

We are a specialist in the financial services industry primarily focused on governance, risk management, finance, ESG, digital and other banking practices. We provide the following services to client: